As the pharmaceutical industry closes 2025, the medical writing sector has undergone a profound transformation. The global medical writing market reached USD 5.10 billion in 2025, with projections expanding to USD 10.26 billion by 2032 at a 10.5% compound annual growth rate, according to Coherent Market Insights. North America’s medical writing market grew to US$1.76 billion in 2024, with projections reaching US$4.23 billion by 2033, while Asia-Pacific emerged as the fastest-growing segment at 29.2% market share. Clinical writing commands 35.6% market share, with in-house medical writers holding 54.3% of the market, though outsourcing to capability centers and contract research organizations continues accelerating.

The AI Revolution: Artificial Intelligence Reshapes Medical Writing

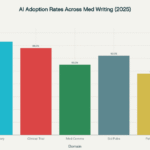

Perhaps the most transformative development centered on artificial intelligence integration throughout medical writing workflows. Deloitte analysis confirms that automating medical writing processes could reduce individual medical writers’ workload by up to 30%. Natural language processing (NLP) and natural language generation (NLG) technologies enable organizations to automate literature reviews, aggregate safety data, and generate initial document drafts with human oversight. Agentic AI capabilities now enable autonomous decision-making within defined parameters.

Healthcare organizations demonstrated markedly increased risk tolerance for AI initiatives during 2025, a substantial shift from 2024. However, medical writers emphasized that artificial intelligence functions optimally as a partnership tool rather than replacement technology. The Veeva PromoMats 2025 Innovation Guide featured advanced agentic AI capabilities, eCTD enhancements, and claims validation improvements. These automation tools in MLR approval platforms reflected vendor responsiveness to industry needs.

Pharmaceutical M&A Drives Industry Consolidation

The pharmaceutical industry witnessed unprecedented consolidation in 2025, with major transactions reshaping competitive dynamics and creating substantial demand for integrated medical communications and regulatory writing capabilities.

Major 2025 pharmaceutical M&A transactions included:

- Eli Lilly & Company’s acquisition of Intra-Cellular Therapeutics ($14.6 billion) for CNS portfolios

- Merck & Co.’s pending acquisition of Verona Pharma ($10.0 billion) for respiratory disease

- Sanofi’s completion of Blueprint Medicines acquisition ($9.5 billion) for rare disease and oncology

- Merck & Co.’s acquisition of Cidara Therapeutics ($9.2 billion) for infectious disease

- Novartis’s acquisition of Regulus Therapeutics ($1.7 billion) for microRNA therapeutics

- AbbVie’s acquisition of Capstan Therapeutics ($2.1 billion) for cell therapy

- Eli Lilly’s acquisition of Verve Therapeutics ($2.3 billion) for gene editing and cardiovascular disease

Each transaction necessitated comprehensive regulatory writing harmonization, clinical documentation integration, and healthcare marketing strategy realignment—creating immediate demand for medical writers, regulatory compliance specialists, and professional services providers.

Industry Leadership: Indegene and Dentsu Health

Indegene, a global capability center, announced strategic hiring throughout 2025 for scientific writing positions emphasizing omnichannel content creation, regulatory compliance, and specialized clinical documentation expertise. Roles emphasized:

- End-to-end publications planning and execution

- Omnichannel promotional content development

- MLR approval platform expertise, particularly Veeva PromoMats proficiency

- Medical claims validation aligned with regulatory compliance standards

- Cross-functional collaboration with medical writers

Dentsu Health, the world’s largest integrated healthcare communications network, demonstrated substantial market influence with $212 million in revenue and approximately 600 employees. The agency’s strategic consolidation under the unified Dentsu Health umbrella emphasized client-centric solutions synthesizing creative expertise, healthcare marketing acumen, and digital transformation capabilities.

The Omnicom-IPG Megamerger: Largest Agency Consolidation

December 2025’s Omnicom-IPG megamerger, finalized as the largest acquisition in advertising history, fundamentally restructured the healthcare communications landscape. The merger created the world’s largest integrated agencies network under Omnicom Health, consolidating previously independent advertising agencies:

- FCB Health

- Area23

- Biolumina

- Neon

- Propeller

- DDB Health (consolidated from multiple entities)

Dana Maiman was named CEO of Omnicom Health, leading approximately 600 healthcare communications professionals and 4,000+ advertising industry professionals post-reorganization. This restructuring established three mega-networks (Omnicom Health, Publicis Health, and Havas Health & You with 6,500+ staff and 90+ offices) as dominant healthcare agencies controlling the vast majority of pharmaceutical marketing budgets.

Professional Conferences: DIA and AMWA Shape 2025

The DIA Medical Writing Conference 2025, held in Bengaluru, India (July 11-12), with the theme “Transforming Medical Writing through Collaboration, Innovation, and Technology,” featured two specialized tracks addressing clinical documentation and regulatory writing evolution. Track 1 covered scientific writing, publication planning, and patient engagement communication. Track 2 emphasized clinical study reports, regulatory submissions, eCTD standards, artificial intelligence applications, and safety documentation (PBRERs, DSURs, SUSARs).

The AMWA 2025 Medical Writing & Communication Conference in Phoenix (November 4-7, 2025) attracted the global medical writing community with an emphasis on AI in healthcare, workflow optimization, and regulatory compliance frameworks. Conference analysis identified three dominant themes:

- Workflow Inefficiency Crisis: Outdated document management systems create critical bottlenecks

- Technology Integration Complexity: Multiple platforms lack seamless integration

- Skill Development Imperative: Rapid artificial intelligence adoption requires reskilling initiatives

AMWA Certification Program Expansion introduced Certificate in Regulatory Documents (September 2025), acknowledging medical writers’ specialization within distinct domains: regulatory writing, clinical documentation, publications planning, and safety documentation.

Specialized Expertise Development: Aggregate Report Writing

Aggregate Report Medical Writing emerged as a specialized career track during 2025, with Indegene and peer organizations announcing dedicated positions focused exclusively on post-marketing safety documentation. These roles emphasized expertise in authoring:

- Periodic Aggregate Reports

- PBRERs (Periodic Benefit-Risk Evaluation Reports)

- DSURs (Development Safety Update Reports)

- SUSARs (Suspected Unexpected Serious Adverse Reactions)

- PADERs/PAERs (Periodic Adverse Drug Experience Reports)

- RMPs (Risk Minimization Plans)

This specialization signaled that the contemporary medical writing industry demands distinct career paths, reflecting pharmaceutical companies’ recognition that post-approval safety documentation requires specialized regulatory compliance expertise.

Emerging Trends: Patient-Centric Communication and Digital Evolution

Regulatory agencies (FDA, EMA) increasingly emphasized patient-centric approaches during 2025, requiring medical writers to develop competency in:

- Plain language summaries (PLS) of technical documentation

- Patient-friendly communication balancing scientific accuracy with accessibility

- Shared decision-making materials supporting informed patient engagement

- Lay summaries for direct-to-consumer advertising contexts

Direct-to-consumer advertising strategies evolved substantially, leveraging personalized messaging, social media channels, and voice search optimization. Healthcare innovation accelerated through digital transformation initiatives emphasizing omnichannel engagement and targeted pharmaceutical marketing.

International Council for Harmonisation (ICH) continued advancing global drug development standards. Medical writers increasingly navigated eCTD standards, regulatory submissions harmonization, regional FDA regulations and EMA compliance requirements, and real-time regulatory intelligence networks.

Emerging therapeutic areas demanding specialized medical writing expertise included gene editing, advanced therapy medicinal products (ATMPs), digital therapeutics (DTx), combination products, personalized medicine, and companion diagnostics.

Market Size and Growth Projections

Global Medical Writing Market Valuation:

- 2025 Current Value: USD 5.10 billion

- 2032 Projected Value: USD 10.26 billion

- CAGR: 10.5% (2025-2032)

- North America 2025: US$1.76 billion (projected US$4.23 billion by 2033)

- Asia-Pacific: 29.2% share in 2025 (fastest-growing region)

- Clinical writing market share: 35.6% (largest segment)

- In-house vs. outsourced: 54.3% in-house, accelerating outsourcing trend

By therapeutic area, oncology dominates at 24.3% market share, reflecting current pharmaceutical companies’ R&D investment priorities in cancer treatment, cardiovascular disease, and diabetes management.

Challenges and Industry Pressures

Skilled medical writer shortage persists despite market growth. Specialized medical writers (oncology, rare disease, gene therapy) command premium compensation. 3-5 year training periods for entry-level professional development limit rapid capacity scaling. Geographic concentration of expertise (North America, Europe, India) creates service delivery delays.

Regulatory complexity continues escalating across jurisdictions. Multi-jurisdictional regulatory submissions require synchronized professional approaches. ICH harmonization remains incomplete in key emerging markets. Shifting regulatory compliance standards and eCTD adoption timelines require constant capability updates.

AMWA 2025 conference data confirmed that outdated document management systems create critical bottlenecks. Manual review processes delay regulatory submissions. Multiple platform integrations create workflow handoffs. Quality assurance verification requires excessive resources. Change tracking and version control consume disproportionate time.

Conclusion: Evolution and Future Trajectory

The medical writing industry in 2025 demonstrated remarkable resilience amid technological disruption and professional services consolidation. Defining characteristics include:

- Artificial Intelligence as Operational Baseline: Artificial intelligence integration moved from “innovation exploration” to “standard professional practice” across pharmaceutical companies and healthcare communications organizations.

- Consolidation Creating Competitive Scale: Pharmaceutical M&A activity and healthcare agency consolidation concentrated expertise within fewer, larger organizations delivering integrated professional services across therapeutic areas.

- Specialization Necessity: Entry-level medical writing positions diminished; the market increasingly demands either generalist excellence or specialist depth, requiring continuous professional development.

- Regulatory Complexity Driving Outsourcing: Rather than in-house absorption, pharmaceutical companies increasingly outsourced to specialized capability centers possessing current regulatory compliance expertise and technological proficiency.

- Patient-Centric Mandate: Regulatory agencies’ emphasis on patient engagement expanded medical writers’ scope beyond healthcare professional-focused communications.

- Technology as a Competitive Differentiator: Veeva PromoMats, artificial intelligence-enabled MLR approval systems, and structured authoring tools became competitive requirements rather than optional enhancements.

The USD 5.10 billion market size in 2025, with a projected 10.5% CAGR through 2032, reflects investor confidence in sustained demand for professional medical communications. However, this growth paradoxically accompanies workforce challenges, regulatory complexity, and technology adoption costs reshaping pharmaceutical companies, professional services organizations, and healthcare communications agencies through 2026. Medical writers entering 2026 must combine technical regulatory writing expertise, advanced healthcare knowledge, artificial intelligence proficiency, and patient engagement communication acumen—skill integration defining professional success in an industry experiencing fundamental structural transformation.

DISCLAIMER AND ATTRIBUTION STATEMENT

While we have exercised diligence in compiling this report and verifying information from multiple web sources, the dynamic nature of the pharmaceutical and healthcare communications industries means that information may change, become outdated, or require updates. We welcome feedback, corrections, and clarifications from readers, industry professionals, and organization representatives.

This disclaimer reflects our commitment to transparency, professional standards, and continuous improvement of the Content quality and accuracy.

CONTACT FOR CORRECTIONS

For discrepancies, corrections, outdated information, or clarifications regarding any content in this report:

Email: amit@avblogs.in

Please include all relevant details, supporting documentation, and requested corrections as outlined in Section 7 (Changes and Corrections Policy) below.

Response Timeline: Correction requests will be reviewed and acknowledged within 5 business days of receipt.

IMPORTANT DISCLAIMER: Medical Writing Industry 2025: Year-End Report

This report and all accompanying materials (“the Content”) have been compiled through comprehensive web-based research and industry analysis conducted as of December 17, 2025. The following disclaimer and terms apply to all users, readers, and stakeholders accessing or utilizing this Content:

1. SOURCE ATTRIBUTION AND LIMITATIONS

All data, statistics, company information, market figures, industry trends, and analysis presented in this report have been sourced from publicly available web resources, industry publications, professional databases, company announcements, regulatory filings, and third-party market research organizations. While we have exercised reasonable diligence in gathering and verifying information, web-based sources may contain inaccuracies, outdated information, or varying interpretations of data.

2. ACCURACY AND COMPLETENESS

The Content is provided on an “as-is” basis without any warranties, express or implied, regarding accuracy, completeness, or fitness for any particular purpose. Some information may:

- Reflect preliminary or unverified reports from industry sources

- Contain estimates or projections that differ from actual outcomes

- Include information that has been superseded by more recent announcements

- Represent one perspective among multiple possible interpretations

- Contain inadvertent errors or omissions despite our verification efforts

3. INFORMATION QUALITY STANDARDS

While we have attempted to maintain high standards of accuracy and relevance:

- Market figures and projections are subject to change and may not reflect the most current data available at the time of reading

- Company information and organizational structures may have changed since research completion

- Regulatory requirements and compliance standards referenced may have been updated

- Conference details, attendance numbers, and outcomes may differ from preliminary reports

- M&A transaction details may be subject to regulatory approval or modification

- Personnel changes may have occurred after information compilation

4. SPECIALIZED DOMAIN KNOWLEDGE

This Content addresses specialized domains, including medical writing, pharmaceutical industry practices, regulatory compliance, healthcare communications, and professional services. Readers should:

- Consult with domain experts for mission-critical decisions

- Verify current regulatory requirements with appropriate authorities (FDA, EMA, ICH, etc.)

- Cross-reference industry statistics with primary sources

- Consult legal and compliance professionals regarding regulatory matters

- Contact relevant professional associations (AMWA, EMWA, DIA) for current standards

5. KEYWORD OPTIMIZATION AND SEO CONTEXT

This Content has been optimized for search engine visibility and includes strategic keyword integration for professional visibility purposes. The inclusion of specific keywords does not constitute endorsement, verification, or comprehensive coverage of all topics. SEO optimization may influence presentation, emphasis, and topic selection independent of news value or comprehensive analysis.

6. THIRD-PARTY INFORMATION AND COMPANY REFERENCES

References to specific companies, agencies, organizations, and individuals (including Indegene, Dentsu Health, Omnicom Health, AMWA, EMWA, DIA, and others) are based on publicly available information. These references are provided for informational and contextual purposes and do not constitute:

- Official endorsement or partnership

- Verified participation in mentioned events or initiatives

- Comprehensive representation of company activities or capabilities

- Guaranteed accuracy of quoted financial figures or metrics

- Complete attribution of all relevant information

7. CHANGES AND CORRECTIONS POLICY

We recognize that information research conducted on December 17, 2025, may contain inaccuracies, omissions, or information that becomes outdated as industry developments occur. Any party believing they have identified:

- Factual errors or inaccuracies

- Outdated or superseded information

- Misrepresented data or statistics

- Incorrect company information or details

- Incomplete or misleading professional descriptions

- Unverified claims or unsupported assertions

- May submit a detailed correction request to: amit@avblogs.in

CORRECTION REQUEST GUIDELINES:

When submitting correction requests, please include:

- Specific Section and Content: Identify the exact section, paragraph, or statement requiring correction

- Nature of Discrepancy: Clearly explain why the information is inaccurate, outdated, or incomplete

- Supporting Documentation: Provide evidence, sources, or documentation supporting the correction request (links, publications, official announcements, regulatory filings, etc.)

- Corrected Information: Provide the accurate information with proper attribution and sourcing

- Contact Information: Include your name, title, organizational affiliation, and contact details for follow-up

- Timeline: Specify whether this correction addresses urgent inaccuracies or represents updated information

- Relationship Declaration: If submitting as a company representative or interested party, disclose your relationship to the information being corrected

CORRECTION REVIEW AND RESPONSE:

Upon receipt of a correction request meeting the above guidelines, the content ownership team will:

- Acknowledge receipt within 5 business days

- Conduct independent verification of the claimed discrepancy

- Request additional documentation if necessary

- Evaluate the significance and scope of the identified issue

- Implement verified corrections in updated versions

- Provide notification of corrections made

- Maintain a correction log for transparency

NOTE: Correction requests should be submitted in English and include sufficient supporting documentation for independent verification. Requests lacking adequate detail or documentation may require follow-up before processing.

8. LIABILITY LIMITATIONS

To the maximum extent permitted by law, the authors, publishers, and distributors of this Content shall not be liable for:

- Any damages, direct or indirect, arising from reliance on this Content

- Business decisions made based on information contained herein

- Financial losses resulting from market projections or analysis

- Regulatory non-compliance resulting from outdated regulatory references

- Professional or reputational harm from inaccurate descriptions

- Any other consequences of Content accuracy, completeness, or applicability

9. PROFESSIONAL CONSULTATION REQUIREMENT

This Content is provided for informational and professional awareness purposes. Readers should:

- Conduct independent research and verification before making business decisions

- Consult legal counsel regarding regulatory compliance matters

- Engage domain experts for professional services and strategic planning

- Verify current industry standards with professional associations

- Update information sources regularly to account for industry changes

- Use professional judgment and critical evaluation when applying information

10. REPORT SCOPE AND UPDATES

This report represents a snapshot of industry conditions, trends, and information as of December 17, 2025. The pharmaceutical and healthcare communications industries evolve continuously. This report does not:

- Constitute ongoing monitoring or real-time updates

- Represent future market conditions or industry developments

- Guarantee information accuracy beyond the report publication date

- Provide predictive guarantees regarding industry trends

- Cover all relevant developments or organizations in these sectors

- Serve as a substitute for current professional industry intelligence

Users should consult current industry publications, professional association announcements, regulatory agency guidance, and primary business sources for the most up-to-date information.

11. SEO OPTIMIZATION AND CONTENT PRESENTATION

This Content has been developed with search engine optimization principles applied to enhance professional visibility and discovery. This optimization may result in:

- Emphasis on keyword integration that influences topic selection and presentation

- Keyword variations that affect writing style and vocabulary

- Topic clustering that may emphasize certain areas beyond comprehensive coverage

- Keyword frequency that may exceed typical editorial standards

These factors may influence how information is presented and emphasized, independent of editorial judgment regarding importance or accuracy.

12. SOURCES AND ATTRIBUTION

This Content draws from multiple public sources including:

- Industry research reports and market analysis publications

- Company announcements and press releases

- Professional association websites and publications

- Conference announcements and agendas

- Regulatory agency information

- Academic and professional journals

- Industry news publications

- Third-party market research organizations

- LinkedIn and professional networking sources

Complete source attribution is provided throughout the report where specific data points are referenced. However, synthesis and analysis based on multiple sources may not explicitly attribute every informational component.

13. GOVERNING PRINCIPLES

This disclaimer is governed by principles of transparency, professional integrity, and responsible information dissemination. We acknowledge the limitations inherent in web-based research and the dynamic nature of the pharmaceutical and healthcare communications industries.

By accessing and utilizing this Content, you acknowledge:

- Understanding these limitations and disclaimers

- Responsibility for independent verification of critical information

- Non-reliance on this Content as sole source for professional decisions

Agreement to contact amit@avblogs.in with correction requests or identified discrepancies